Consumer payments have shifted decisively towards digital options since 2019.

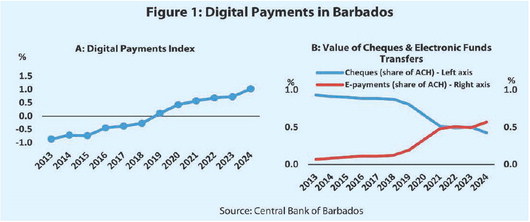

As it prepares to launch the national instant payments system (IPS) BiMPay at the end of March, the Central Bank of Barbados has published a Digital Payments Index (DPI) detailing the country’s digital payment evolution.

The monetary authority did so while making it clear that “even with rapid digital uptake, cash continues to play a trusted role in smaller transactions and for persons who prefer traditional methods”.

In an analysis titled The Digital Payment Evolution In Barbados, the Central Bank said that “Barbados’ payment habits continue to migrate from cash and cheques to faster electronic methods”.

“The Central Bank’s Digital Payments Index signals broad adoption of digital options.

Continue Reading on The Nation Barbados

This preview shows approximately 15% of the article. Read the full story on the publisher's website to support quality journalism.