When Belgian Prime Minister Bart De Wever put his foot down at last month's EU summit and blocked a bold plan to issue a €140 billion reparations loan to Ukraine using the immobilised assets of the Russian Central Bank, he complained of being singled out.

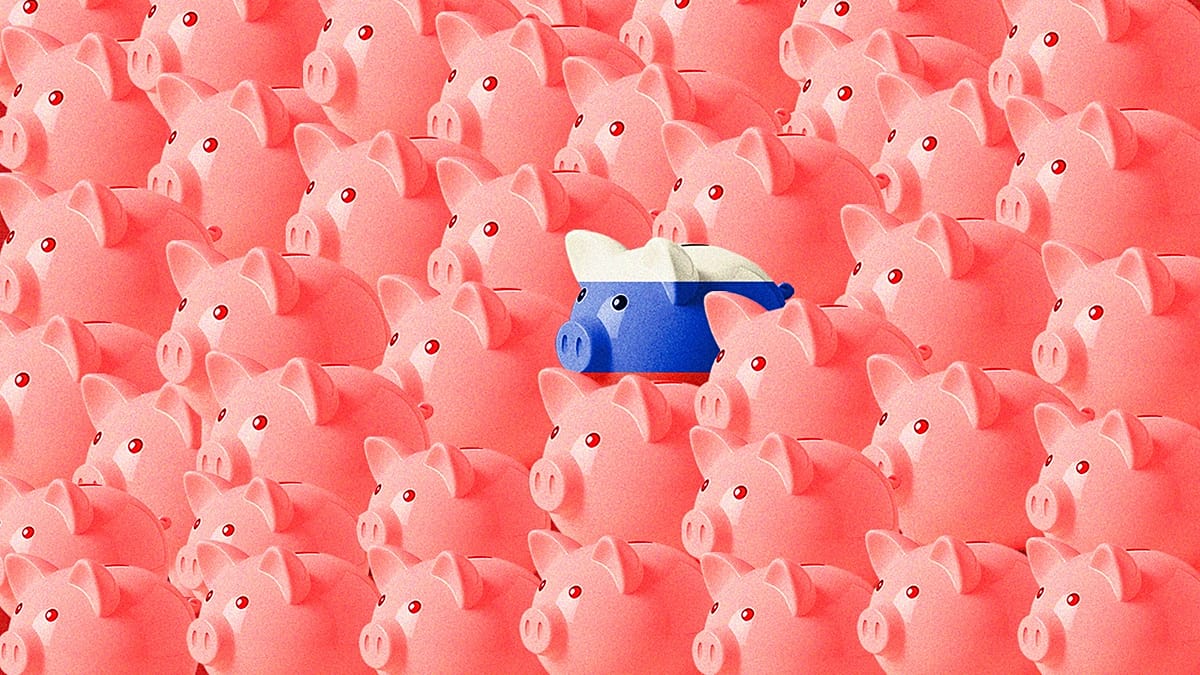

After all, the audacious project is solely based on the funds held at Euroclear, a central securities depository based in Brussels, despite G7 allies repeatedly saying they have about €300 billion in paralysed sovereign assets spread across their jurisdictions.

"The fattest chicken is in Belgium, but there are other chickens around," De Wever said. "Nobody ever talks about this."

Indeed, nobody, or hardly anybody, does.

Following De Wever's remarks at the inconclusive summit, Euronews reached out to the Western countries that, through media reports and independent analyses, have been identified as holding a share of the Russian Central Bank's assets.

These are: France, Luxembourg, Germany, Switzerland, the United Kingdom, the United States, Canada, Japan and Australia, all of which are aligned with the international effort to cripple the Kremlin's war machine and bring the invasion of Ukraine to an end.

Ironically, the most precise replies ca

Continue Reading on Euronews

This preview shows approximately 15% of the article. Read the full story on the publisher's website to support quality journalism.